SEEBURGER and Sovos have long enjoyed a successful partnership in the area of global e-invoicing. We are proud to bring you the SEEBURGER-branded version of the Sovos Annual Trends Report in its 12th Edition.

It is one of the most comprehensive reports on VAT compliance, B2B and B2G e-invoicing compliance globally and an essential read for multinationals.

The report is about

- Four mega trends and how these have been accelerated by COVID19

- A summary of global compliance requirements by region and country

- Background information to e-invoicing and VAT reporting

Four mega trends accelerated by COVID19

Watch our webcast How Always-on VAT Compliance will Transform your Business Post-COVID19 to see Christiaan van der Valk presenting the 4 mega trends from the report.

- Continuous Transaction Controls (CTCs)

- A shift toward destination taxability for certain cross-border transactions

- Aggregator liability

- E-accounting and e-assessment

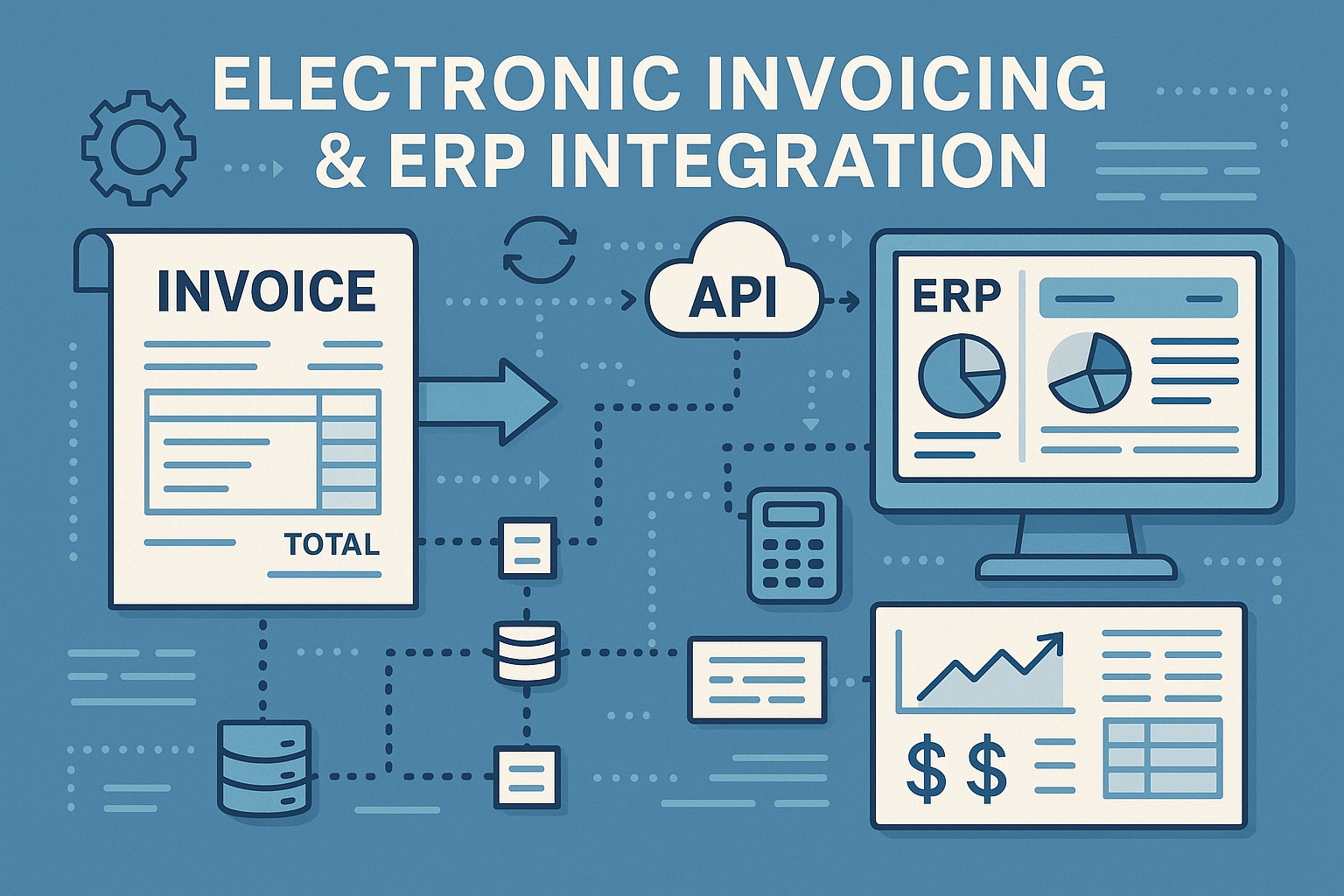

We are an experienced provider of e-invoicing cloud services, offering a single-source solution to enable you to comply with global and specific local legislation, both within Europe and further afield. SEEBURGER Global E-Invoicing Services integrate with SAP’s eDocument Cockpit on SAP ECC or on S/4HANA, or with any other ERP system.

Source: https://blog.seeburger.com/sovos-annual-trends-report-vat-trends-toward-continuous-transaction-controls/

cashflowix.com

cashflowix.com