The integration of electronic invoicing systems with Enterprise Resource Planning platforms represents one of the most transformative developments in modern financial management, fundamentally reshaping how organizations approach accounts payable and receivable processes while establishing new benchmarks for operational efficiency, regulatory compliance, and strategic business intelligence. This convergence of technologies addresses the growing complexity of global business operations, where traditional manual invoicing processes have become increasingly inadequate for supporting the speed, accuracy, and transparency demanded by contemporary enterprise environments.

Enterprise Resource Planning systems have long served as the backbone of organizational operations, centralizing data management across various business functions including finance, procurement, inventory management, human resources, and customer relationship management. However, the invoicing components within traditional ERP implementations often struggle to keep pace with evolving regulatory requirements, customer expectations, and the sophisticated automation capabilities that modern electronic invoicing platforms provide. This technological gap has created significant opportunities for organizations that successfully bridge these systems, enabling unprecedented levels of process automation, data visibility, and operational control.

The strategic importance of integrating electronic invoicing with ERP systems extends far beyond simple process automation or cost reduction initiatives. Organizations that master this integration gain competitive advantages through enhanced cash flow management, improved supplier relationships, reduced compliance risks, and the ability to leverage financial data for strategic decision-making. Moreover, as regulatory environments continue to evolve globally, with increasing mandates for electronic invoicing compliance, integrated systems provide the flexibility and adaptability necessary to maintain operations across multiple jurisdictions while ensuring consistent adherence to varying regulatory requirements.

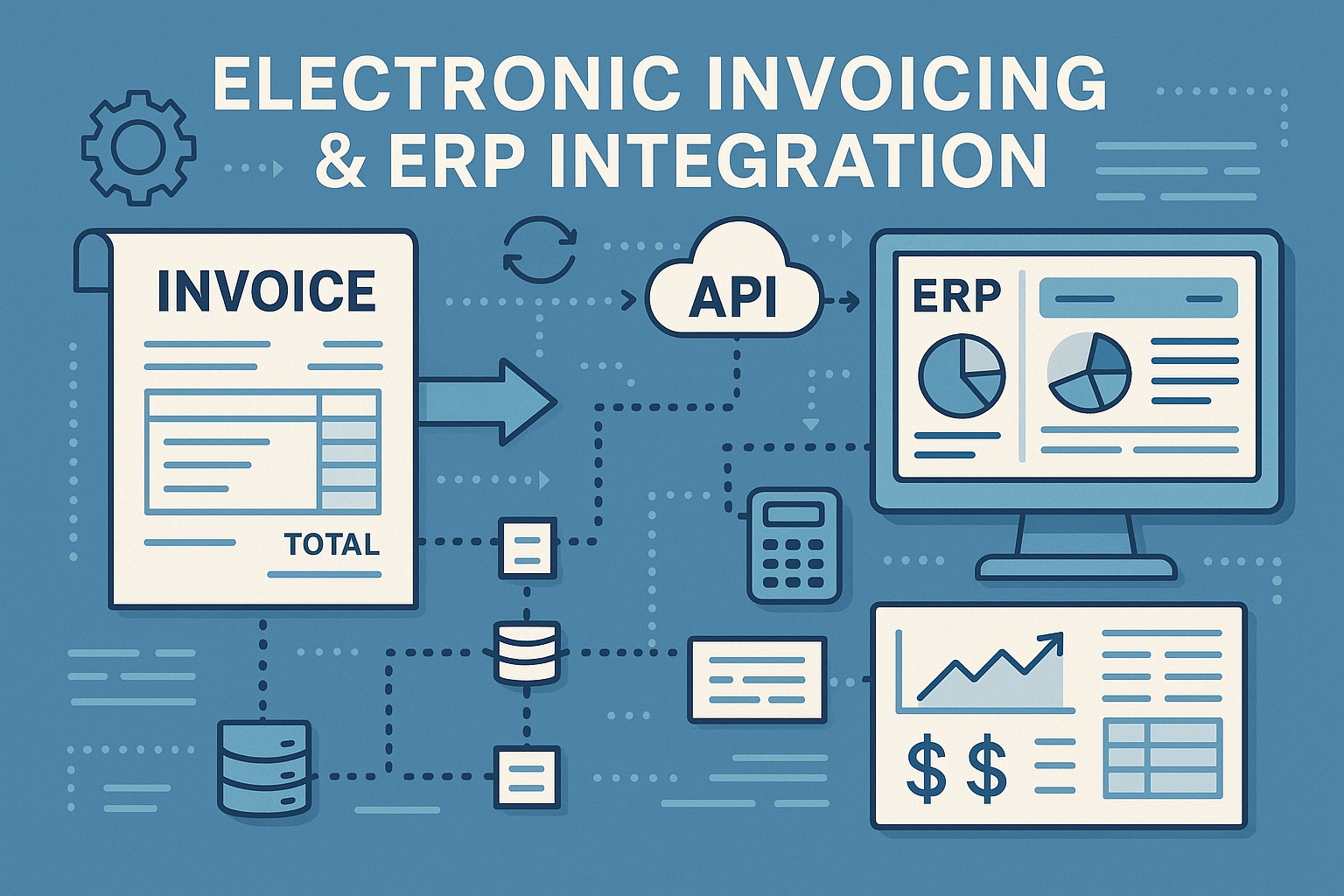

Contemporary electronic invoicing integration represents a sophisticated technological undertaking that requires careful consideration of data architecture, workflow design, user experience optimization, and change management strategies. Unlike simple point-to-point connections between systems, modern integration approaches leverage advanced middleware solutions, application programming interfaces, and cloud-based orchestration platforms to create seamless, bi-directional data flows that maintain data integrity while enabling real-time processing capabilities. These technical considerations become even more complex when organizations operate across multiple geographical regions, currencies, and regulatory frameworks, requiring integration solutions that can adapt to diverse requirements while maintaining consistent performance standards.

The financial implications of successful ERP and electronic invoicing integration are substantial and multifaceted. Organizations typically experience immediate benefits through reduced manual processing costs, decreased error rates, and accelerated payment cycles, while also gaining long-term strategic advantages through improved financial visibility, enhanced audit capabilities, and the ability to leverage automated analytics for predictive financial modeling. Research indicates that organizations with fully integrated electronic invoicing and ERP systems can reduce invoice processing costs by up to seventy percent while simultaneously improving processing speed by similar margins, creating compelling business cases for integration initiatives.

Security considerations within integrated ERP and electronic invoicing environments require comprehensive approaches that address both data protection and system integrity concerns. The sensitive nature of financial data flowing between systems demands robust encryption protocols, access control mechanisms, and audit trail capabilities that can satisfy both internal governance requirements and external regulatory mandates. Modern integration architectures incorporate advanced security frameworks including multi-factor authentication, role-based access controls, and real-time monitoring systems that can detect and respond to potential security threats before they impact business operations.

The evolution of cloud-based ERP and electronic invoicing solutions has fundamentally altered the integration landscape, providing organizations with deployment options that were previously unavailable or prohibitively expensive. Cloud-native integration platforms offer scalability, reliability, and maintenance advantages that can significantly reduce the total cost of ownership while providing access to cutting-edge features and capabilities that are continuously updated and improved. However, cloud integration also introduces new considerations around data sovereignty, network connectivity, and hybrid deployment scenarios that must be carefully evaluated and addressed during the planning and implementation phases.

Workflow automation represents one of the most significant benefits of integrated ERP and electronic invoicing systems, enabling organizations to establish sophisticated approval processes, exception handling procedures, and escalation mechanisms that can operate with minimal human intervention. Advanced workflow engines can incorporate artificial intelligence and machine learning capabilities to optimize routing decisions, predict approval outcomes, and identify potential issues before they impact processing timelines. These automated workflows not only improve operational efficiency but also enhance compliance by ensuring consistent application of policies and procedures across all transactions.

Data quality and standardization challenges often emerge as critical success factors during ERP and electronic invoicing integration projects. Disparate data formats, inconsistent coding schemes, and varying validation rules between systems can create significant obstacles to achieving seamless integration. Successful implementations typically incorporate comprehensive data governance frameworks that establish standardized data models, validation procedures, and cleansing protocols that ensure consistent data quality across all integrated systems. These data management initiatives often reveal opportunities for broader organizational improvements in data stewardship and information management practices.

The role of middleware and integration platforms has become increasingly sophisticated in modern ERP and electronic invoicing integration scenarios. Contemporary middleware solutions provide not only technical connectivity but also business logic capabilities, transformation services, and monitoring functions that can significantly simplify integration complexity while providing operational visibility and control. Enterprise Service Bus architectures, API management platforms, and iPaaS solutions offer different approaches to integration challenges, each with distinct advantages and considerations that must be evaluated within the context of specific organizational requirements and technical constraints.

Performance optimization within integrated ERP and electronic invoicing environments requires careful attention to system architecture, data flow patterns, and resource utilization characteristics. High-volume transaction processing can strain system resources and impact user experience if not properly managed through appropriate hardware provisioning, software configuration, and monitoring protocols. Advanced performance management techniques including load balancing, caching strategies, and parallel processing capabilities can ensure that integrated systems maintain responsive performance even under peak transaction loads.

Change management considerations for ERP and electronic invoicing integration extend beyond traditional technology adoption challenges to encompass fundamental shifts in business processes, role definitions, and organizational responsibilities. Successful integration projects typically incorporate comprehensive training programs, stakeholder engagement initiatives, and phased rollout strategies that allow organizations to adapt gradually to new capabilities while maintaining operational continuity. These change management efforts often reveal opportunities for process reengineering and organizational optimization that can amplify the benefits of system integration.

Vendor selection and relationship management become critical considerations when integrating ERP and electronic invoicing systems, particularly when dealing with multiple technology providers, support organizations, and service levels. Successful integration projects require clear delineation of responsibilities, well-defined service level agreements, and coordinated support processes that can address issues spanning multiple systems and vendors. Strategic vendor partnerships can provide access to specialized expertise, accelerated implementation timelines, and ongoing innovation that can enhance the long-term value of integration investments.

Regulatory compliance management within integrated ERP and electronic invoicing environments requires sophisticated approaches that can accommodate varying requirements across different jurisdictions, industries, and transaction types. Modern integration architectures incorporate configurable compliance engines that can automatically apply appropriate validation rules, generate required documentation, and maintain audit trails that satisfy regulatory requirements while minimizing the burden on operational personnel. These compliance capabilities often extend beyond basic invoicing requirements to encompass broader financial reporting, tax management, and governance obligations.

The measurement and optimization of integration performance require comprehensive metrics frameworks that can capture both technical performance indicators and business outcome measures. Key performance indicators typically include transaction processing speeds, error rates, user satisfaction scores, cost savings achievements, and compliance performance metrics that provide visibility into the overall effectiveness of integrated systems. Advanced analytics capabilities can identify trends, predict potential issues, and recommend optimization strategies that can continuously improve integration performance and business value.

Testing and validation strategies for ERP and electronic invoicing integration must address not only technical functionality but also business process integrity, data accuracy, and user experience quality. Comprehensive testing protocols typically incorporate unit testing, integration testing, performance testing, security testing, and user acceptance testing phases that ensure all aspects of the integrated solution function correctly before deployment. Automated testing capabilities can significantly reduce testing time and improve coverage while providing ongoing regression testing capabilities that ensure system stability as changes and updates are implemented.

| Integration Architecture Components | Traditional Approach | Modern Cloud-Native Approach | Advanced AI-Enhanced Approach |

| Data Connectivity | Point-to-point connections | API-based microservices | Intelligent data orchestration |

| Process Automation | Rule-based workflows | Event-driven automation | Machine learning optimization |

| Error Handling | Manual intervention required | Automated retry mechanisms | Predictive error prevention |

| Scalability | Hardware-dependent scaling | Elastic cloud resources | AI-driven capacity management |

| Monitoring | Basic system alerts | Real-time dashboards | Proactive analytics insights |

The financial modeling and business case development for ERP and electronic invoicing integration require sophisticated analysis that considers both quantitative benefits and qualitative improvements across multiple time horizons. Direct cost savings from reduced manual processing, decreased error correction expenses, and improved payment terms must be balanced against implementation costs, ongoing maintenance expenses, and potential disruption impacts during transition periods. Advanced financial modeling techniques can incorporate sensitivity analysis, scenario planning, and risk assessment methodologies that provide comprehensive understanding of investment implications and expected returns.

International considerations for ERP and electronic invoicing integration become increasingly complex as organizations expand across multiple countries and regions with varying regulatory requirements, currency considerations, and cultural business practices. Integration architectures must accommodate multiple languages, tax systems, and compliance frameworks while maintaining consistent user experiences and operational procedures. Global deployment strategies often require phased regional rollouts, localized testing procedures, and region-specific support capabilities that can address unique local requirements while maintaining global consistency and control.

The emergence of artificial intelligence and machine learning capabilities within integrated ERP and electronic invoicing systems represents a significant evolution in automation sophistication and business intelligence potential. Advanced AI capabilities can optimize approval routing, predict payment behaviors, identify fraud patterns, and recommend process improvements that can continuously enhance system performance and business outcomes. These intelligent features often require substantial data volumes and extended learning periods to achieve optimal performance, making long-term strategic planning and data strategy development critical success factors.

Industry-specific considerations for ERP and electronic invoicing integration can significantly impact architecture decisions, compliance requirements, and operational procedures. Manufacturing organizations may require integration with production planning systems and supply chain management platforms, while service companies might prioritize project accounting and resource management capabilities. Healthcare organizations face unique regulatory requirements around patient data privacy and audit trail maintenance, while financial services companies must comply with sophisticated risk management and reporting obligations that influence integration design decisions.

User experience design within integrated ERP and electronic invoicing systems must balance functionality requirements with usability considerations across diverse user communities including accounting personnel, procurement specialists, approvers, and external suppliers or customers. Modern integration approaches increasingly emphasize mobile accessibility, intuitive interface design, and personalized user experiences that can adapt to individual roles and preferences while maintaining consistent security and compliance controls. Advanced user experience capabilities may include voice interfaces, automated data entry, and predictive user assistance that can significantly improve productivity and user satisfaction.

Data archiving and retention management within integrated ERP and electronic invoicing environments require comprehensive strategies that address both operational performance and regulatory compliance requirements. Large volumes of historical transaction data can impact system performance while regulatory requirements may mandate specific retention periods and retrieval capabilities for audit and legal purposes. Advanced archiving solutions can provide automated data lifecycle management, intelligent storage tiering, and on-demand retrieval capabilities that optimize system performance while maintaining compliance obligations.

| Integration Success Factors | Technical Requirements | Business Process Impact | Organizational Readiness |

| System Compatibility | API availability and documentation | Process standardization needs | Technical skill availability |

| Data Quality | Validation and cleansing capabilities | Exception handling procedures | Change management capacity |

| Performance Requirements | Scalability and response time needs | Transaction volume planning | User training requirements |

| Security Standards | Encryption and access control features | Audit trail maintenance | Compliance expertise |

| Support Infrastructure | Monitoring and troubleshooting tools | Help desk integration | Vendor relationship management |

The continuous improvement and optimization of integrated ERP and electronic invoicing systems require systematic approaches to performance monitoring, user feedback collection, and technology evolution management. Successful organizations typically establish ongoing optimization programs that can identify improvement opportunities, evaluate new capabilities, and implement enhancements that maintain competitive advantage and operational excellence. These improvement initiatives often reveal additional integration opportunities with other business systems and processes that can further amplify the value of initial integration investments.

Integration governance frameworks become essential for managing the complexity and ongoing evolution of integrated ERP and electronic invoicing systems. Comprehensive governance structures typically encompass technical architecture standards, data management policies, security protocols, and change control procedures that ensure consistent and reliable system operation while enabling controlled innovation and enhancement. Effective governance frameworks also establish clear roles and responsibilities for system administration, user support, and strategic planning activities that maintain system value and business alignment over time.

The future evolution of ERP and electronic invoicing integration will likely be influenced by emerging technologies including blockchain, quantum computing, and advanced artificial intelligence that can provide new capabilities for security, performance, and business intelligence. Organizations that establish flexible and adaptable integration architectures today will be better positioned to leverage these emerging technologies as they mature and become commercially viable. Strategic technology planning and architecture design decisions made during current integration projects can significantly impact an organization’s ability to adapt and evolve with technological advancement and changing business requirements.

Disaster recovery and business continuity planning for integrated ERP and electronic invoicing systems must address the critical nature of financial processes and the potential impact of system outages on business operations. Comprehensive disaster recovery strategies typically incorporate redundant system architectures, automated backup procedures, and tested recovery protocols that can restore operations within acceptable timeframes while maintaining data integrity and compliance requirements. Advanced business continuity approaches may include geographically distributed processing capabilities and real-time data replication that can provide near-instantaneous failover capabilities in the event of system disruptions.

In conclusion, the integration of electronic invoicing systems with ERP platforms represents a strategic imperative for organizations seeking to optimize financial operations, enhance competitive positioning, and prepare for an increasingly digital business environment. Success requires comprehensive planning, sophisticated technical implementation, and ongoing optimization efforts that address both immediate operational needs and long-term strategic objectives. Organizations that master these integration challenges gain significant advantages through improved efficiency, enhanced compliance capabilities, and the foundation for continued innovation and growth in dynamic market conditions. The investment in properly designed and implemented ERP and electronic invoicing integration pays dividends through reduced costs, improved performance, and enhanced business agility that can support sustained competitive advantage in an increasingly complex and demanding business environment.

| Implementation Phase Considerations | Planning and Design | Development and Testing | Deployment and Optimization |

| Timeline Expectations | 6-12 months for comprehensive integration | 3-8 months for development and testing cycles | 2-6 months for phased deployment |

| Resource Requirements | Business analysts, technical architects, project managers | Developers, testers, security specialists | Trainers, support staff, optimization experts |

| Risk Mitigation | Thorough requirements analysis, vendor evaluation | Comprehensive testing protocols, rollback planning | User training, performance monitoring |

| Success Measurement | Clear objectives and KPIs definition | Quality metrics and acceptance criteria | Performance benchmarks and improvement targets |

| Ongoing Considerations | Change management and stakeholder engagement | Security validation and performance optimization | Continuous improvement and evolution planning |

cashflowix.com

cashflowix.com